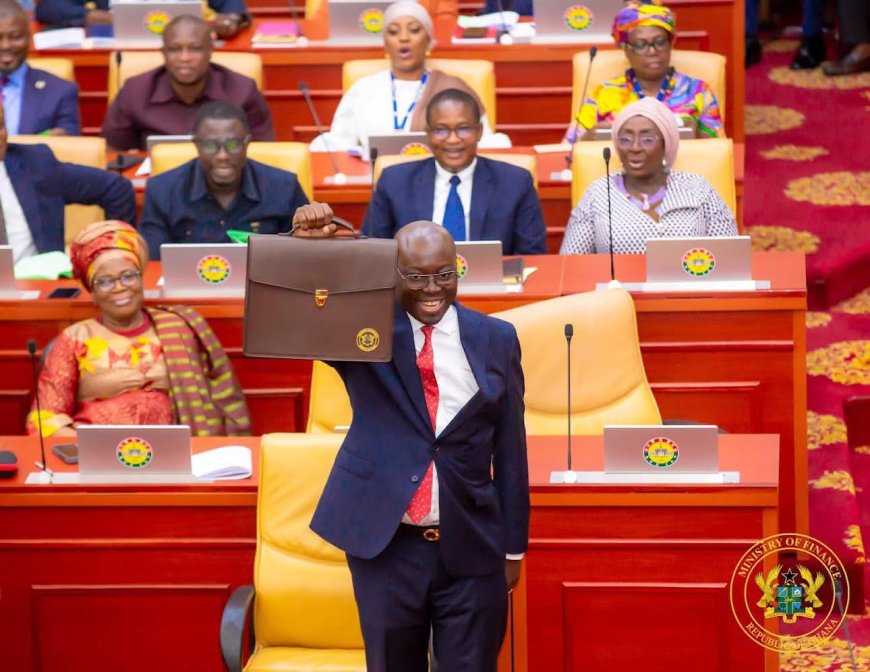

Dr. Ato Forson to Present 2026 Budget to Parliament on November 13

Finance Minister Dr. Ato Forson is expected to present Ghana’s 2026 Budget and Economic Policy to Parliament on November 13. The budget is set to focus on job creation, tax reforms, and economic growth as the country prepares to exit the IMF programme in 2026.

Finance Minister Dr. Ato Forson is expected to deliver the 2026 Budget Statement and Economic Policy to Parliament on November 13, according to information obtained by MaregoTV from reliable sources close to the budget preparation process.

The proposed date, pending Parliamentary approval, will mark the first major budget presentation by the current administration since securing victory in the 2024 general elections. The government has had nearly nine months to implement its policies and steer the economy toward recovery and growth.

Observers note that the 2025 Budget largely operated within the framework of the previous administration, making the upcoming 2026 budget a key opportunity for the Forson-led Finance Ministry to stamp its policy direction.

By law, the Finance Minister, acting on behalf of the President, must present the national budget to Parliament no later than November 15 each year.

Consultations and Policy Focus

Sources say the Finance Ministry has concluded several rounds of stakeholder and industry consultations to finalize the fiscal strategies and policy measures to be included in the 2026 Budget.

Dr. Forson has previously hinted that this year’s budget will prioritize job creation, economic revitalization, and growth stimulation. He has also suggested introducing tax reforms to enhance revenue generation while making the tax system more efficient and business-friendly.

Expected Tax Reforms

According to GRA Commissioner-General Anthony Sarpong, the 2026 Budget will include a review of the Value Added Tax (VAT). The effective rate is anticipated to drop from 22% to 20%, as part of efforts to simplify the VAT structure and promote business competitiveness.

In addition, the Finance Minister is expected to review several existing tax levies, including the COVID-19 levy, to reduce the overall tax burden on businesses and households.

With Ghana’s IMF programme scheduled to conclude in May 2026, the upcoming budget will play a crucial role in shaping the country’s post-programme economic strategy. Analysts will be watching closely to see how the government plans to sustain growth, manage debt, and maintain macroeconomic stability beyond the IMF era.

The 2026 Budget is, therefore, expected to serve as a critical policy document, defining the government’s fiscal management, revenue strategies, and development priorities for the years ahead.